From billion-dollar ghost towns to thriving bankrupt neighborhoods.

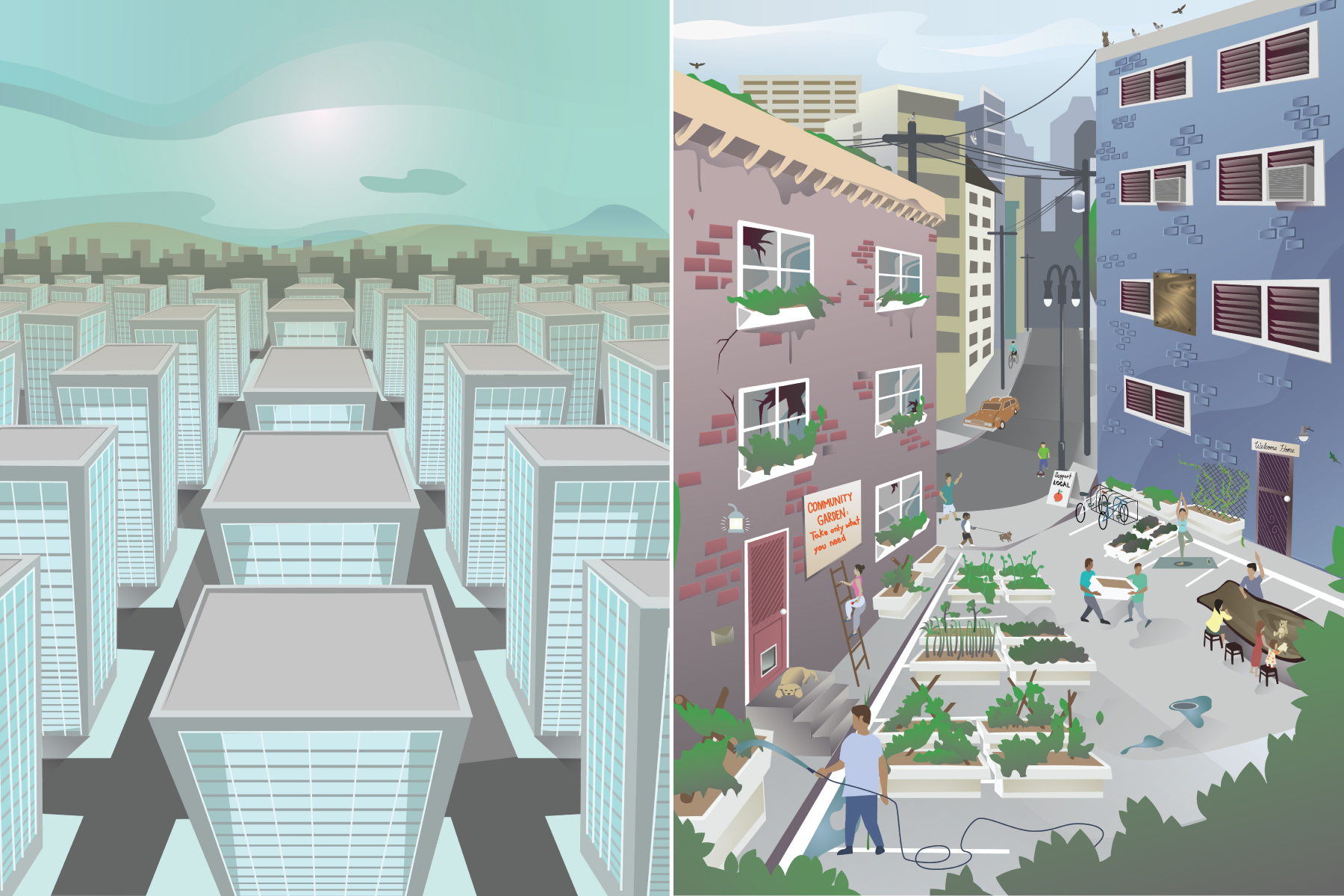

In our visions of post-apocalyptic cities, part of the horror is what happens when economies fail, when direct deposit vanishes and bartering of goods is the only means of exchange. But the inverse, when wealth pours into a city without restraint, can be just as alarming.

Take, for instance, London, a city wracked by over-investment. Money from newly minted Russian gas magnates and Gulf State heirs has set the overheated property market to boiling, while deadening the street life of some of the area’s most historic neighborhoods (not to mention, hurting the restaurants and shops).

Critics bemoan the eerie emptiness of London’s urban core, which is suffering from a distinct lack of people even as apartments are snapped up as investment assets by domestic and foreign buyers.

An estimated 22,000 properties in London are uninhabited or “long-term empty.” Swanky districts like Kensington are strikingly dark at night, and London’s One Hyde Park, possibly the most expensive residential building in the world, has primarily absentee owners.

Nightmares of desolate boomtown cities circle the globe. The western city of Ordos is China’s most famous ghost city, built to house more than a million people, yet with only 2 percent of the buildings filled. Throughout the country, dozens of new cities have been built in a frenzy fueled by property speculation and municipal governments’ push for revenue.

Imagine our city as an investment portfolio instead of a place to live, where neighborhoods echo only with the footsteps of the property manager coming by to tour the tomb-like bank vault of security alarmed apartments.

Though the rows of apartment complexes have found domestic investors, many of the apartments remain empty. Even bustling Manhattan is dotted with strangely silent voids, what one real estate appraiser called “the equivalent of bank safe deposit boxes in the sky that buyers can put all their valuables in and rarely visit.”

Maybe no one wants to live in rainy London or Inner Mongolia, but surely this cannot be true for the ocean-front city of Honolulu, consistently ranked high in livability indexes? Alas, remember Kawamoto, the garish billionaire who left million-dollar properties to rot in Kahala?

The giant pool of money sloshing around in the global economy has already brought blight to these shores. Imagine our city as an investment portfolio instead of a place to live, where neighborhoods echo only with the footsteps of the property manager coming by to tour the tomb-like bank vault of security alarmed apartments.

Honolulu’s collapse of urban life may not come in Great Depression-style financial conflagration, with stockbrokers tumbling down with the Dow Jones. It may instead come humming in on wire transfers, a flood tide of capital that erodes livelihoods with each long-term empty apartment it buys.

On the other hand, what happens when the real estate market tanks, and money marches out of a city? In 2008, images of foreclosed houses dominated the news. People walked away from underwater mortgages, leaving the homes to scavengers and squirrels. But when investment vanishes and land ceases to have market value, other values can flourish.

The most famous contemporary example is Detroit, which declared bankruptcy in 2013 after its economy was decimated by the collapse of the American auto industry. Today, the city is an epicenter of urban agriculture, with some remaining residents turning abandoned lots over to vegetable production.

This model isn’t new. In the 1970s, an era of massive disinvestment in American cities reached its height in New York City after President Gerald Ford refused to bail out the municipality, and the city slashed its operating budget. Landlords began torching their buildings rather than pay for upkeep, resulting in a wave of insurance-claim arson.

In the literal and figurative ashes of the South Bronx, of Harlem, of countless residential neighborhoods, individuals and community organizations began planting. The first community garden in New York City’s Lower East Side was established in 1973 by a group of hippies who started digging without permission in a city-owned lot. By 1995, there were 75 gardens growing in just the 33 blocks from 12th Street and Houston between Avenues A and D.

In Argentina, the economic collapse of 2001 was precipitated by multinational banks “[whisking] $40 billion in cash out of the country in the dead of night” as Argentine’s currency began to plummet. Widespread layoffs and factory closures resulted in massive unemployment.

But at one men’s suit factory, the seamstresses decided that they didn’t need to wait around for an economic revival, and waltzed back in to restart their sewing machines. Their example of a factory takeover inspired hundreds of worker collectives across Argentina, and even in Europe and the United States, where, in the depths of the most recent recession, workers staged sit-ins in factories in Chicago to keep production lines active.

In one dystopian scenario of post-peak Honolulu, the “haves” hoist their shotguns to guard houses they’ve worked hard to acquire, and the “have-nots” scrounge through the stale contents of mini bars in vacant resorts.

In another future after economic collapse, all those empty timeshares become apartments for the formerly houseless, and hotel kitchens turn into community hubs where people bring fish, breadfruit, guava, and kalo to cook together. In the absence of financial capital, wealth could be redefined with different metrics: the land, water, and people right here with us.

This story is part of our Apocalypse Issue.